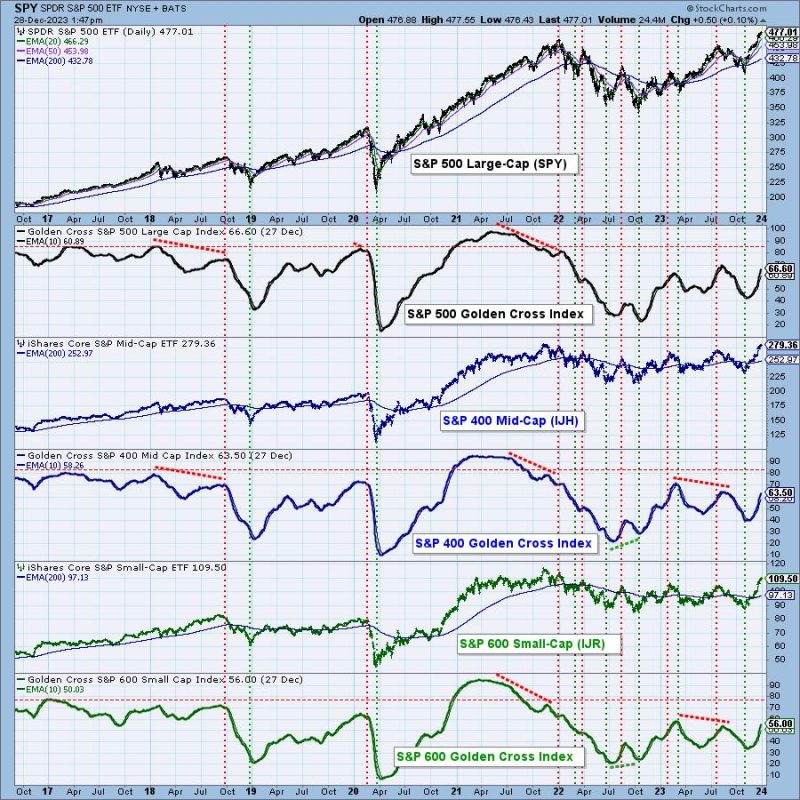

Intermediate-term participation levels are always something to keep an eye on when it comes to investing, and they are particularly important when it comes to long-term investments. As investors, we need to understand the longer-term implications of any market activity and take into consideration things such as the cycle of the markets, tax implications, and inflation when investing. That being said, the current status of the market’s participation levels is something that should be considered when constructing a long-term investment portfolio.

At present, the intermediate-term participation levels are very overbought. This means that the level of trading activity is higher than what is considered “normal”. Generally, overbought conditions can indicate a potential topping out point in a market, as it may indicate that most of the potential buyers have already committed funds into the market, leaving little room for further buying. This can then lead to a scenario where the market retraces or experiences a correction.

Unfortunately, these levels are accompanied by weak long-term participation levels. This means that we might not encounter the typical buying pressure that we see in the intermediate term, and there could be a risk of a further correction if the current level of buying pressure decreases. Weak long-term participation can also indicate that the market is not as attractive to investors over longer periods, as they are more likely to commit funds to other endeavors and not invest in the stock market.

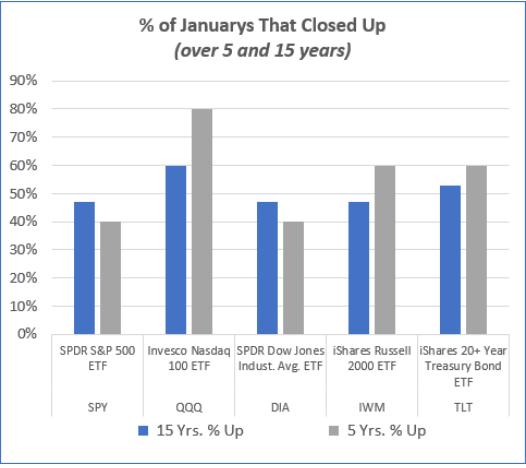

It is important to note, however, that no two investments are the same and that it is important to consider a wide variety of factors when constructing a long-term portfolio. There are many factors to consider when investing such as stock selection, risk management, diversification, and macroeconomic trends. Long-term investors should also keep an eye out for shifting sentiment in the market, as well as any political or economic changes that may affect the long-term performance of a particular investment.

Overall, the current status of the market’s intermediate-term and long-term participation levels should be looked at with caution by long-term investors. While not an indication of a market crash, these levels should nonetheless be taken into consideration when constructing an investment strategy or portfolio. Ultimately, investors need to make their own decisions when it comes to investing and take into account a variety of factors.