As cryptocurrency becomes ever more popular, investors are always eager to explore the latest trends and news announcements in the world of Bitcoin. One of the most recent developments has been the remarkable rise in open interest in Bitcoin futures, a financial derivative where two parties agree to exchange a specified amount of Bitcoin at a set future date and price.

The surging demand can be attributed to the increased use of Bitcoin by institutional investors, particularly those participating in trading related activities. Institutional investors, unlike individual retail investors, possess the resources and network to access high liquidity futures markets. This allows them to take calculated risks that earn them high returns in a short span of time.

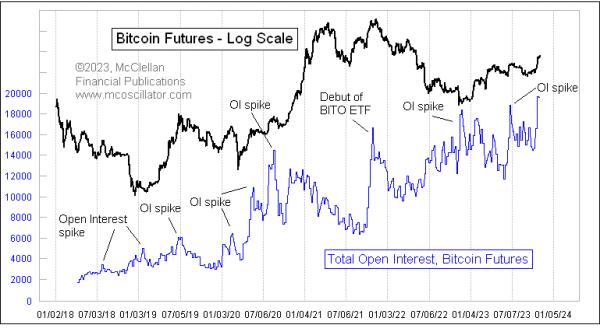

The rise in open interest has been remarkable, with total open interest presently standing at an all-time high of $3 billion. This is an unprecedented number, especially considering the large number of institutional investors that have been involved in this bull-market rally.

A closer look at the data reveals that the increase in open interest is strongly correlated to the current Bitcoin rally. This is because institutional investors often purchase futures contracts during periods of bullish sentiment when Bitcoin prices are on the rise. By doing so, they can speculate on the future direction of Bitcoin’s price and make substantial profits when the positions are eventually closed.

Interestingly, the spike in open interest is unlikely to be a short-term phenomenon, as the rapid growth of the cryptocurrency market is expected to continue well into the near future. This is primarily due to factors such as the increasing volatility of the market and adoption of cryptocurrencies by financial organizations.

Given the current momentum, it is likely that Bitcoin’s open interest will continue to build up and attract new investors from all around the world. In the end, the increased demand generated by Bitcoin’s success is likely to be beneficial for everyone involved, including both crypto traders and the underlying blockchain ecosystem.