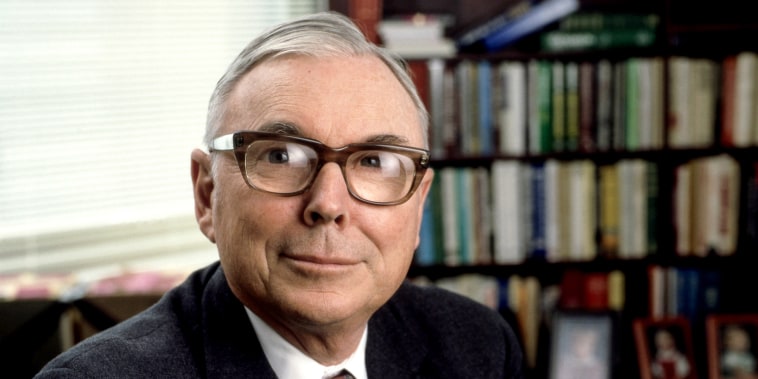

Charlie Munger, the investing genius and the right-hand man of Warren Buffett, has died at the age of 99.

The sad news of Charlie Munger’s death was announced on Friday, February 26th. The causes of his death have yet to be determined by his family. Munger was a renowned investor and he served as Warren Buffett’s right-hand man. He was considered one of the greatest investors of all time, and was highly respected in the industry.

Munger was born in Omaha, Nebraska in 1924. He attended the University of Michigan, where he obtained his Bachelor of Arts degree in 1947. In 1948, he joined the US Army for two years and later earned a law degree from Harvard University in 1951. In 1959, he became a partner at a law firm in Los Angeles.

In 1962, Munger met Warren Buffett, who was already the chairman of Berkshire Hathaway. Munger became an invaluable partner to Buffett, and in 1978, he was appointed vice-chairman of the firm. The duo transformed Berkshire Hathaway into a global conglomerate and revolutionized the investment industry.

Munger was known to be a conservative investor. He was an advocate of value investing, which focuses on buying stocks at discount prices and holding them for the long-term. He was also a believer in diversification, and advocate for the idea of having a well-diversified portfolio. He also pushed for Berkshire Hathaway to be well diversified in different industries.

Munger was also known for having an unconventional approach to investing. He believed that investors should look at businesses from a holistic background and focus more on managing risk than on return.

Munger will be remembered not only for his immense contribution to the investment world but also for his ethos of giving back to society. He and Buffett donated a large portion of their earnings to charity and advocated for the need to move away from consumerism and focus more on building sustainable and equitable communities.

Munger’s death marks a huge loss in the investment world. He was a pioneer in the industry and he will be remembered as one of the greatest investors of his time. He leaves behind a legacy that will continue to influence future generations of investors.