For those wondering if a market crash is going to happen, the news may be comforting. According to a well-known market indicator, the probability of a crash is a mere 0%. This report breaks down the indicators that are used to determine if a crash is on the horizon and why the chances are incredibly low.

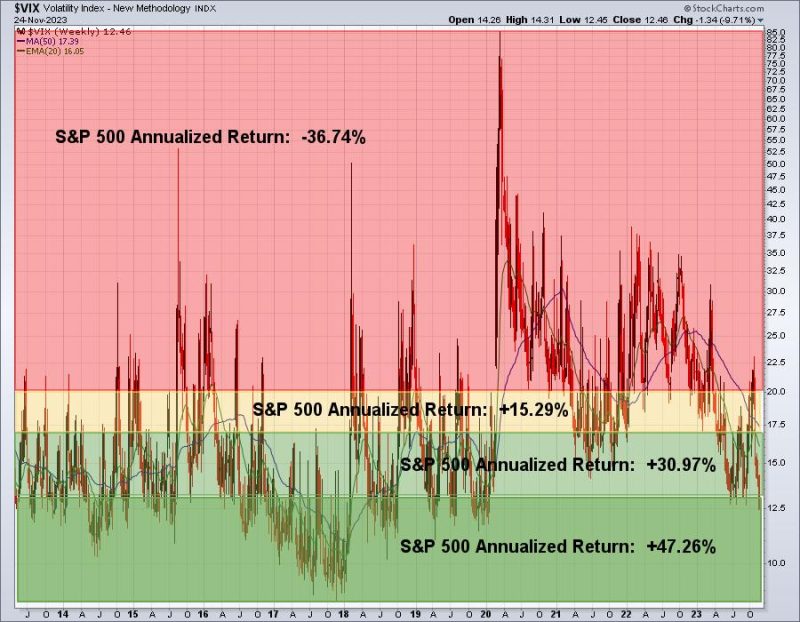

The indicator in question is the Chicago Board Options Exchange (CBOE) Volatility Index (VIX). It’s one of the most relied-upon market indicators and according to the VIX, market volatility is below its long-term average. This indicates that further declines are unlikely in the near future and market timing to speculate a crash is a poor strategy. This is also backed up by market data which shows that market volatility has remained stable over the past few months.

Furthermore, the current economic environment is also playing a part in keeping investors’ confidence high. The US economy is growing slowly yet steadily and unemployment levels remain low. Consumers have thus continued to purchase goods and services, keeping demand high at a time when supply remains limited. In addition to this, the US Federal Reserve has committed to keeping interest rates low for the foreseeable future, meaning companies and consumers can afford to finance their purchases. All these factors are contributing to a generally positive outlook for the US economy, and in turn, investors.

It’s important to note that none of the above is a guarantee that a crash won’t happen. The best strategy for investors in the current environment is to stay informed about economic and market developments, and to make wise decisions when investing. Although the chances of a crash are low, it pays to be cautious and prepared for all potential outcomes.

All in all, the indicator in question suggests that the chances of a crash are low. Despite this, it’s important for investors to be mindful of potential risks and be aware of the changing economic environment. A market crash is not certain, but it pays to be prepared for one should it happen.